Succession Planning for Business Owners

Succession Planning for Business Owners

Business owners deal with a unique set of challenges. One of these challenges includes succession planning. A succession plan is the process of the transfer of ownership, management and interest of a business. When should a business owner have a succession plan? A succession plan is required through the survival, growth and maturity stage of a business. All business owners, partners and shareholders should have a plan in place during these business stages.

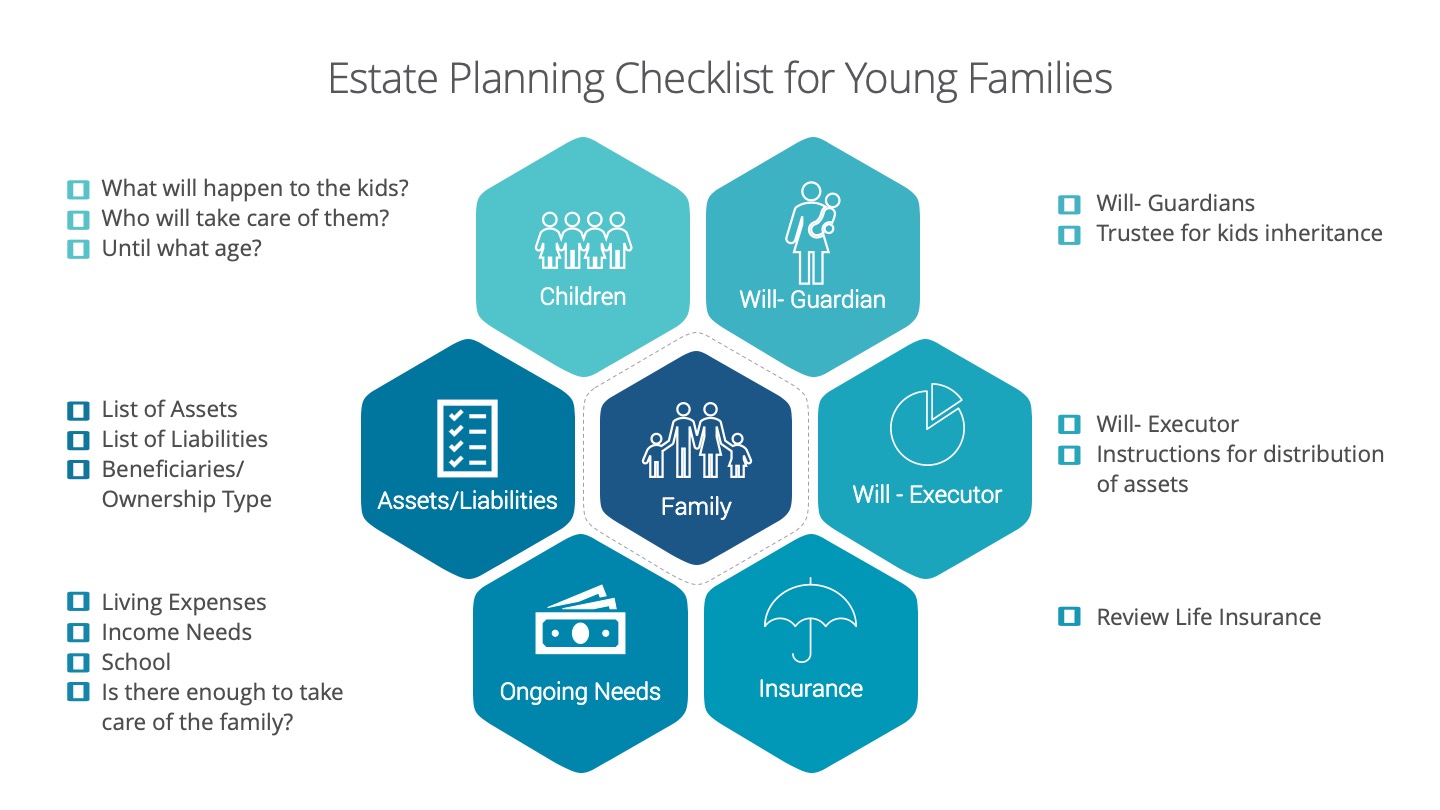

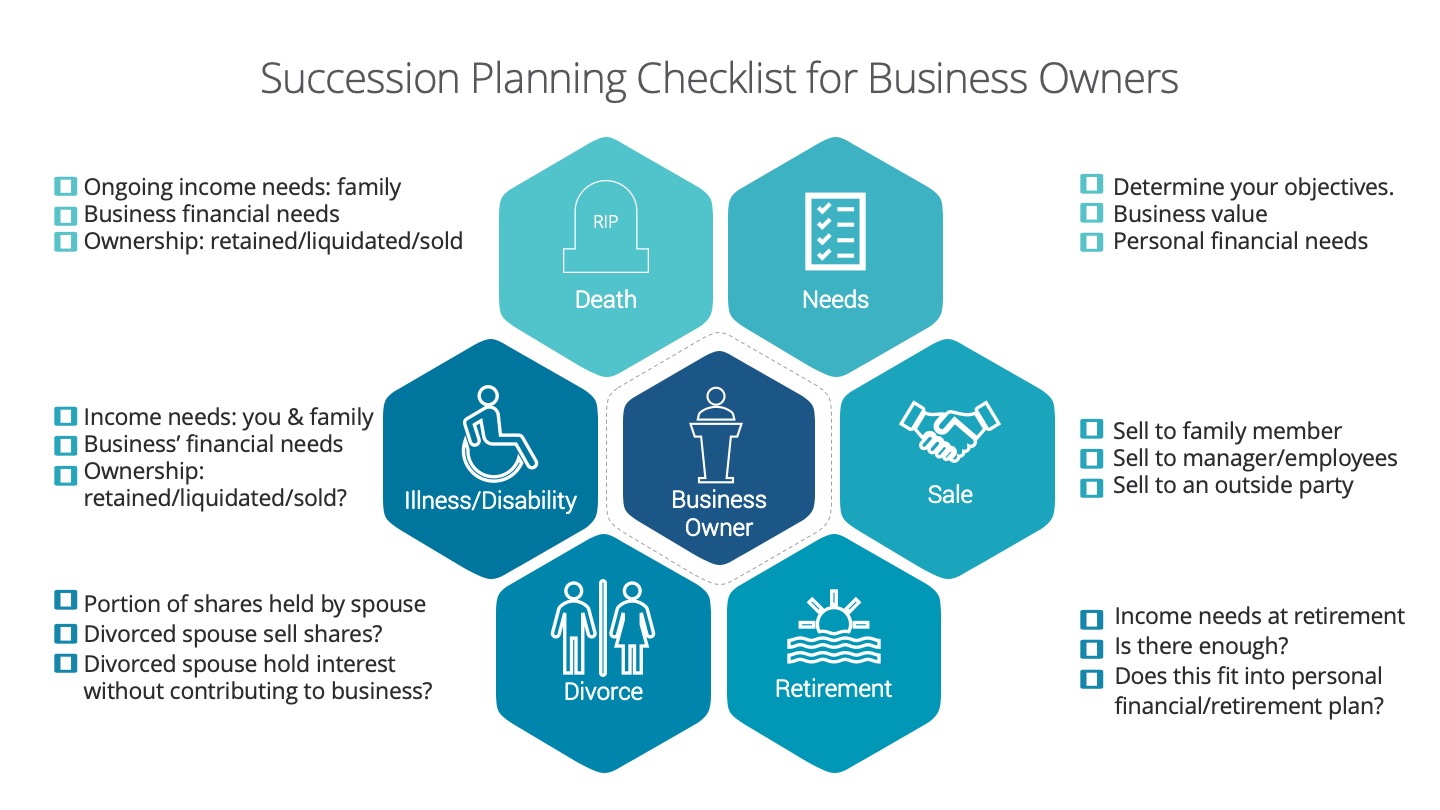

We created this infographic checklist to be used as a guideline highlighting main points to be addressed when starting to succession plan.

Needs:

-

Determine your objectives- what do you want? For you, your family and your business. (Business’ financial needs)

-

What are your shares of the business worth? (Business value)

-

What are your personal financial needs- ongoing income needs, need for capital (ex. pay off debts, capital gains, equitable estate etc.)

There are 2 sets of events that can trigger a succession plan: controllable and uncontrollable.

Controllable events

Sale: Who do you sell the business to?

-

Family member

-

Manager/Employees

-

Outside Party

-

There are advantages and disadvantages for each- it’s important to examine all channels.

Retirement: When do you want to retire?

-

What are the financial and psychological needs of the business owner?

-

Is there enough? Is there a need for capital to provide for retirement income, redeem or freeze shares?

-

Does this fit into personal/retirement plan? Check tax, timing, corporate structures, finances and family dynamics. (if applicable)

Uncontrollable Events

Divorce: A disgruntled spouse can obtain a significant interest in the business.

-

What portion of business shares are held by the spouse?

-

Will the divorced spouse consider selling their shares?

-

What if the divorced spouse continues to hold interest in the business without understanding or contributing to the business?

-

If you have other partners/shareholders- would they consider working with your divorced spouse?

Illness/Disability: If you were disabled or critically ill, would your business survive?

-

Determine your ongoing income needs for you, your spouse and family. Is there enough? If there is a shortfall, is there an insurance or savings program in place to make up for the shortfall amount?

-

Will the ownership interest be retained, liquidated or sold?

-

How will the business be affected? Does the business need capital to continue operating or hire a consultant or executive? Will debts be recalled? Does the business have a savings or insurance program in place to address this?

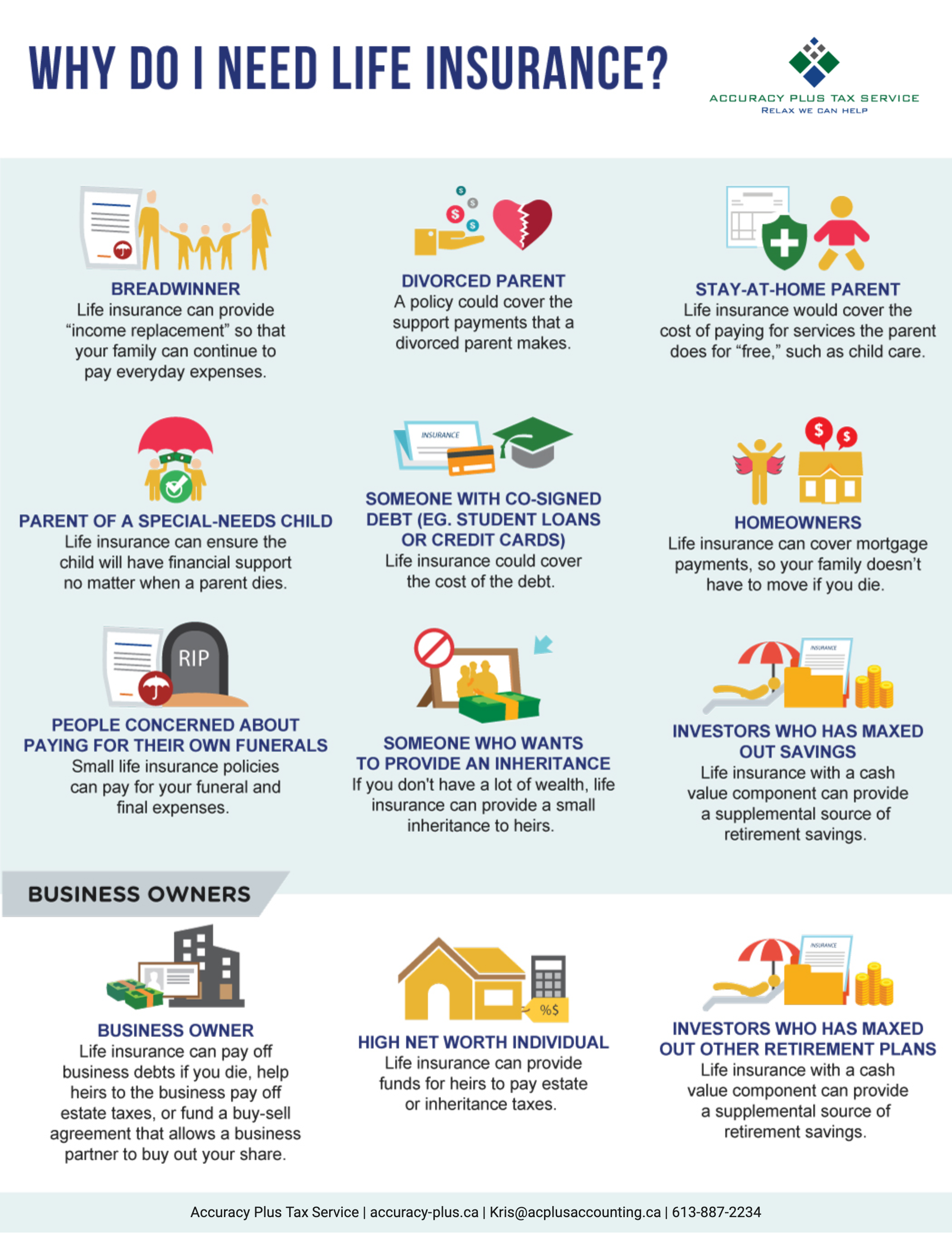

Death: In the case of your premature death, what would happen to your business?

-

Determine your ongoing income needs for your dependents. Is there enough? If there is a shortfall, is there an insurance or savings program in place to make up for the shortfall amount?

-

Will the ownership interest be retained, liquidated or sold by your estate? Does your will address this? Is your will consistent with your wishes? What about taxes?

-

How will the business be affected? Does the business need capital to continue operating or hire a consultant or executive? Will debts be recalled? How will this affect your employees? Does the business have a savings or insurance program in place to address this?

Execution: It’s good to go through this with but you need to get a succession plan done. Besides having a succession plan, make sure you have an estate plan and buy-sell/shareholders’ agreement.

Because a succession plan is complex, we suggest that a business owner has a professional team to help. The team should include:

-

Financial Planner/Advisor (CFP)

-

Succession Planning Specialist

-

Insurance Specialist

-

Lawyer

-

Accountant/Tax Specialist

-

Chartered Life Underwriter (CLU)

Next steps…

-

Contact us about helping you get your succession planning in order so you can gain peace of mind that your business is taken care of.