Personal taxes

ACCURACY PLUS TAX SERVICE: FINANCIAL PLANNING IN KINGSTON & NAPANEE

Accuracy Plus Tax Service can take care of your finances. As experts, we make it our mission to provide intelligent financial solutions, ranging from bookkeeping to financial planning in Kingston, Napanee and the surrounding areas. We also serve both residential and commercial clients.

OUR SERVICES ALSO INCLUDE:

- Back taxes or tax problems

- Tax planning

- Insurance and estate planning

- Business tax returns

- HST housing rebates

Accuracy Plus Tax Service is proud to have two locations (in Kingston and Napanee) to better serve you. If you feel overwhelmed by your monthly bank statements, tax returns or about choosing the right mutual funds, relax: we can help!

Latest News

Succession Planning for Business Owners

Business owners deal with a unique set of challenges. One of these challenges includes succession planning. A succession plan is the process of the transfer of ownership, management and interest of a business. When should a business owner have a succession plan? A succession plan is required through the survival, growth and maturity stage of a business. All business owners, partners and shareholders should have a plan in place during these business stages.

Life Insurance after 60- is it necessary?

You may have had life insurance for as long as you can remember. You knew it was important to make sure that your family would be taken care of and be able to pay their bills if anything happened to you.

But now that you’re over 60, your children are grown, and your mortgage is paid off, you may feel you don’t need life insurance anymore. However, there are some circumstances under which it may still make sense for you to have life insurance:

• You still have substantial debt.

• You have dependent children or grandchildren.

• You want to be able to leave a financial legacy.

Easy Exit: Business Succession in a Nutshell

Getting into the world of business is a meticulous task, but so is getting out of it Whether you’ve just hit the ground running on your business or if you’ve been at it for a long time, there is no better time to plan your exit strategy than now.

Estate Planning for Young Families

Having a family is a blessing and can also bring a lot of worry. A lot of this worry can stem from not being prepared for a disaster like if something were to happen to you or your spouse.

We've put together an infographic checklist that can help you get started on this. We know this can be a difficult conversation so we're here to help and provide guidance.

Importance of a Buy-Sell Agreement

Working as a partnership between 2 or more individuals is never an easy task, and the situation only gets more complicated when one or more of them exits the business. Protecting not only the business, but your personal interests, as well as your family’s future are very important objectives for any business owner, and should not be overlooked.

Estate Freeze

An estate freeze can be an integral part of your estate planning strategy. The purpose of an estate freeze is to transfer any future increase in your business's value (generally shares) that you own to someone else.

Group Insurance vs Individual Life Insurance

While it’s great to have group coverage from your employer or association, in most cases, people don’t understand the that there are important differences when it comes to group life insurance vs. self owned life insurance.

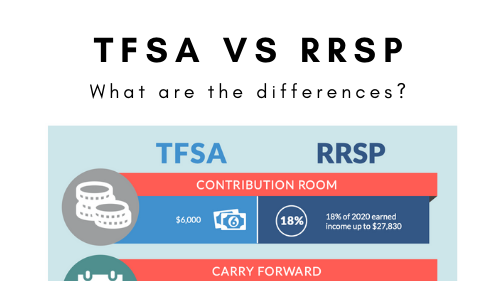

TFSA vs RRSP – What you need to know to make the most of them in 2021

Both TFSAs and RRSPs can be significant savings vehicles for your clients. We've put together an article to help your clients easily understand the differences between them – with one section focussing on differences in deposits and one focussing on differences in withdrawals.

The deposit section focuses on:

• How much contribution room is available each year

• How carry forward works for TFSAs and RRSPs

• Tax deductibility of contributions

• Tax treatment of growth

The withdrawal section focusses on:

• Conversion requirements

• Tax treatment of withdrawals

• Impact of withdrawals on government benefits

• Impact of withdrawals on contribution room

Defined Contribution vs. Benefit Pension Plan for Employees

As an employer, you may be thinking about offering your employees a pension plan. If so, you have two main options: a defined benefit pension plan and a defined contribution pension plan. A defined benefit pension plan offers your employees a set amount of money when they retire, whereas a defined contribution pension plan does not.

We walk you through the differences between the two types of pension plans.

The Difference between Segregated Funds and Mutual Funds

Segregated Funds and Mutual Funds often have many of the same benefits however there are key differences you should consider like Maturity and Death Benefit Guarantees.

The Best Way to Buy Mortgage Insurance

Before buying insurance from your bank to cover your mortgage, please consider your options. What does the insurance cover?

Accessing Corporate Earnings

One of the financial planning issues that business owners face is how to access their corporate earnings in a tax efficient way. Please contact us to learn how we can get more money in your pocket than in the government's.

Insurance Planning for Business Owners

For business owners, making sure your business is financially protected can be overwhelming. Business owners face a unique set of challenges when it comes to managing risk. Insurance can play an important role.

Insurance Planning for Young Families

For young families, making sure your family is financially protected can be overwhelming, especially since there’s so much information floating online. This infographic addresses the importance of insurance- personal insurance.

Salary vs Dividend

As a business owner, you have the ability to pay yourself a salary or dividend or a combination of both. In this article and infographic, we will examine the difference between salary and dividends and review the advantages and disadvantages of each.

10 Essential Decisions for Business Owners

Business owners can be busy… they’re busy running a successful business, wearing lots of hats and making a ton of decisions. We've put together a list of 10 essential decisions for every business owner to consider.

Retirement Planning for Business Owners – Checklist

As a business owner, one of your challenges is learning how to balance between reinvesting into the business and setting money aside for personal savings. Since there are no longer employer-sponsored pension plans and the knowledge that retirement will come eventually, it’s important to have a retirement plan in place.

We've put together an infographic checklist that can help you get started on this.

6 Steps to Retirement Success

Retirement planning can be challenging, we’ve outlined what we feel are 6 steps to retirement success. Talk to us about a complimentary comprehensive review of your retirement plan.

Estate Planning for Business Owners

What happens when the children grow up and they are no longer dependent on their parents? What happens to your other "baby"- the business? Estate planning for business owners deals with the personal and business assets.

When and Why You Should Conduct an Insurance Audit

As our lives grow and change with variable circumstances, new additions, and job transitions, our needs for insurance will also evolve. Additionally, economic fluctuations and external circumstances that influence your insurance policy will need frequent re-evaluation to ensure that you are making the most appropriate and financially favorable decisions. Talk to us we can help.

Real Estate or Investments?

One of the age-old financial quandaries asked of financial advisors is “shall I invest in property or funds?”. Predictably, the answer is not at all straightforward and depends on many factors, including your own financial style, personality and circumstances. Let’s take a look at the pros and cons of each choice to help you to be better informed about which could be the most lucrative option for you

Do you REALLY need life insurance?

You most likely do, but the more important question is, What kind? Whether you’re a young professional starting out, a devoted parent or a successful CEO, securing a life insurance policy is probably one of the most important decisions you will have to make in your adult life. Most people would agree that having financial safety nets in place is a good way to make sure that your loved ones will be taken care of when you pass away. Insurance can also help support your financial obligations and even take care of your estate liabilities.

Shared Ownership Critical Illness

Shared Ownership Critical Illness offers business owners and incorporated business professionals a way to access the retained earnings in their corporation or provide benefits to a key employee.

Talk to us to see how we can help you.

Financial Planning for Business Owners

Financial Planning for business owners is often two-sided: personal financial planning and planning for the business.

Business owners have access to a lot of financial tools that employees don't have access to; this is a great advantage, however it can be overwhelming too. A financial plan can relieve this.

A financial plan looks at where you are today and where you want to go. It determines your short, medium and long term financial goals and how you can reach them. For you, personally and for your business.

Retirement Planning for Business Owners

Retirement planning can be a complex process for us all, but if you are the owner of a small business it may can get even more complicated, due to the various factors and circumstances that you have to take into consideration. A common mistake made by small business owners is reinvesting extra money to grow their business, at the expense of putting it aside to save for their retirement.

2 Locations to Serve You

KINGSTON

6-775 Strand Blvd

Kingston, ON K7P 2S7

613-887-2234

Kris@acplusaccounting.ca

NAPANEE

#4-140 Industrial Blvd

Napanee, ON, K7R 3Y9

613-354-2385